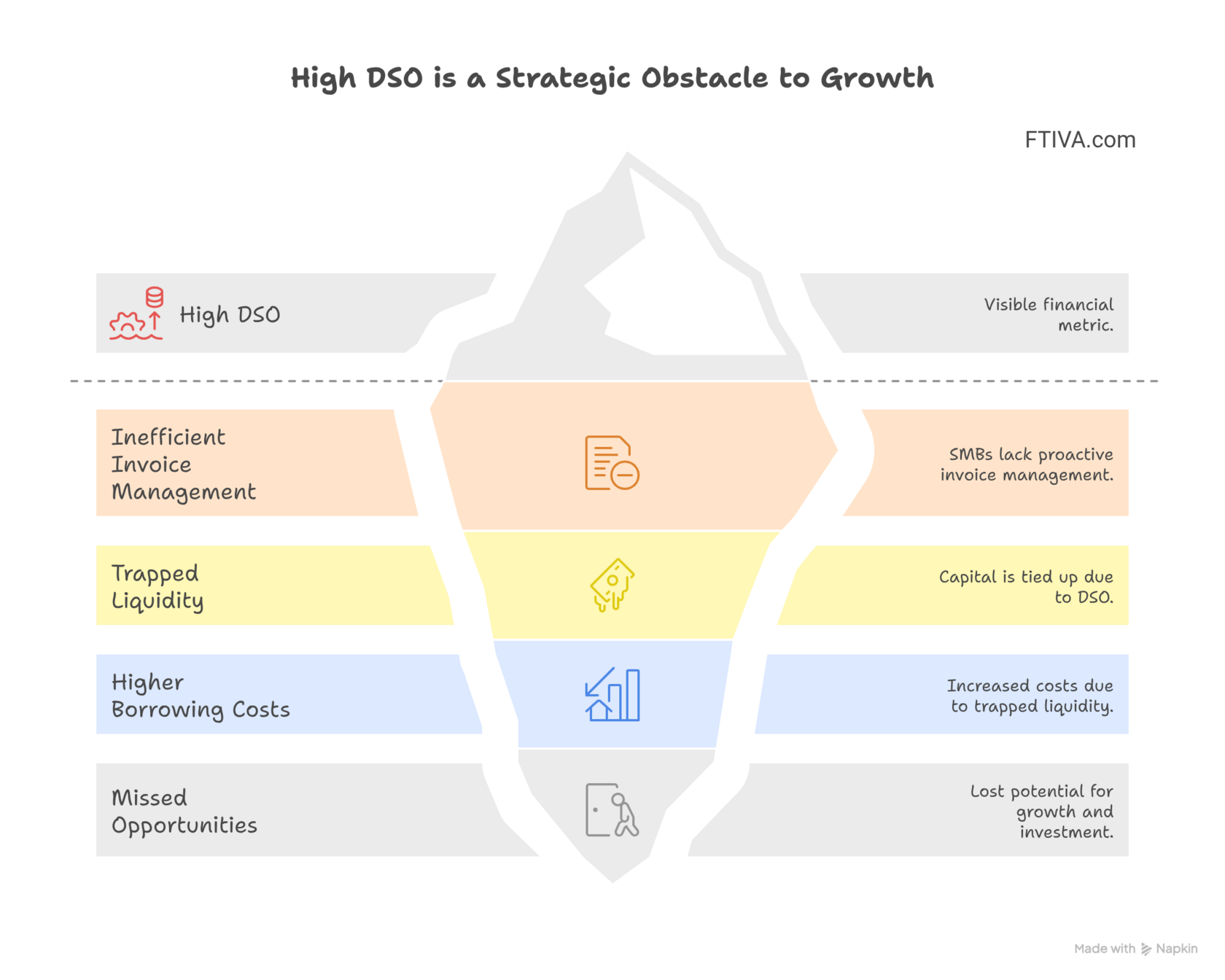

For years, Days Sales Outstanding (DSO) was seen as a finance department metric—a number buried deep in a spreadsheet. But a high DSO isn't just a number; it's a silent force that can derail a CEO's most ambitious plans. It represents a promise unfulfilled and a limitation on your company's potential.

It’s time to move beyond the formula and see DSO for what it really is: a strategic obstacle to growth.

Large organisations have already proven the impact of proactive invoice management on DSO. That’s exactly what SMBs need today — and what FTIVA delivers.

📊 According to PwC’s Working Capital Study 23/24, global Days Sales Outstanding (DSO) improved by 3.1 days (6%), showing that tighter collections directly improve cash flow resilience. In the EU, regulation-driven improvements cut DSO by 6.7 days and DPO (supplier payments) by 11.5 days, reaching five-year lows.

But PwC highlights that these gains are concentrated among large enterprises, while SMBs still lag behind pre-pandemic levels. For smaller companies, inefficient DSO means trapped liquidity, higher borrowing costs, and missed opportunities.

That’s why FTIVA’s proactive, AI-driven invoice management is so critical — it gives SMBs the same disciplined cash-flow advantage that big companies already enjoy.

“Every additional day of DSO ties up roughly $2.7M in working capital for a $1B revenue company (The Hackett Group, 2024).”

The Domino Effect of a High DSO

A high DSO is a direct indicator of slow cash flow, and its impact creates a damaging ripple effect across your entire organization.

- Stalled Innovation: You can't invest in new technology, research, or product development when your capital is locked up in outstanding invoices. A high DSO forces you into a "maintenance mode," where you can't get ahead of the curve.

- Missed Opportunities: Did you just get a new sales lead or a chance to acquire a competitor? A high DSO can prevent you from acting quickly, as you may not have the liquidity to seize the moment.

- Operational Strain: Your finance team is constantly in a reactive state, chasing payments instead of focusing on strategic forecasting or profitability analysis. This robs your business of valuable expertise and bandwidth.

A low DSO, on the other hand, is a green light. It allows you to operate with agility, confidence, and the freedom to pursue your biggest goals.

Industry research shows that for companies with around $1 billion in annual revenue, every additional day of Days Sales Outstanding (DSO) can lock up $2.5–3 million in working capital. Even small improvements in collections efficiency therefore unlock significant liquidity. Leading firms such as Deloitte emphasize that optimizing DSO is critical not only for reducing working capital needs but also for lowering borrowing costs, enhancing liquidity, and funding growth (Deloitte – Working Capital Management).

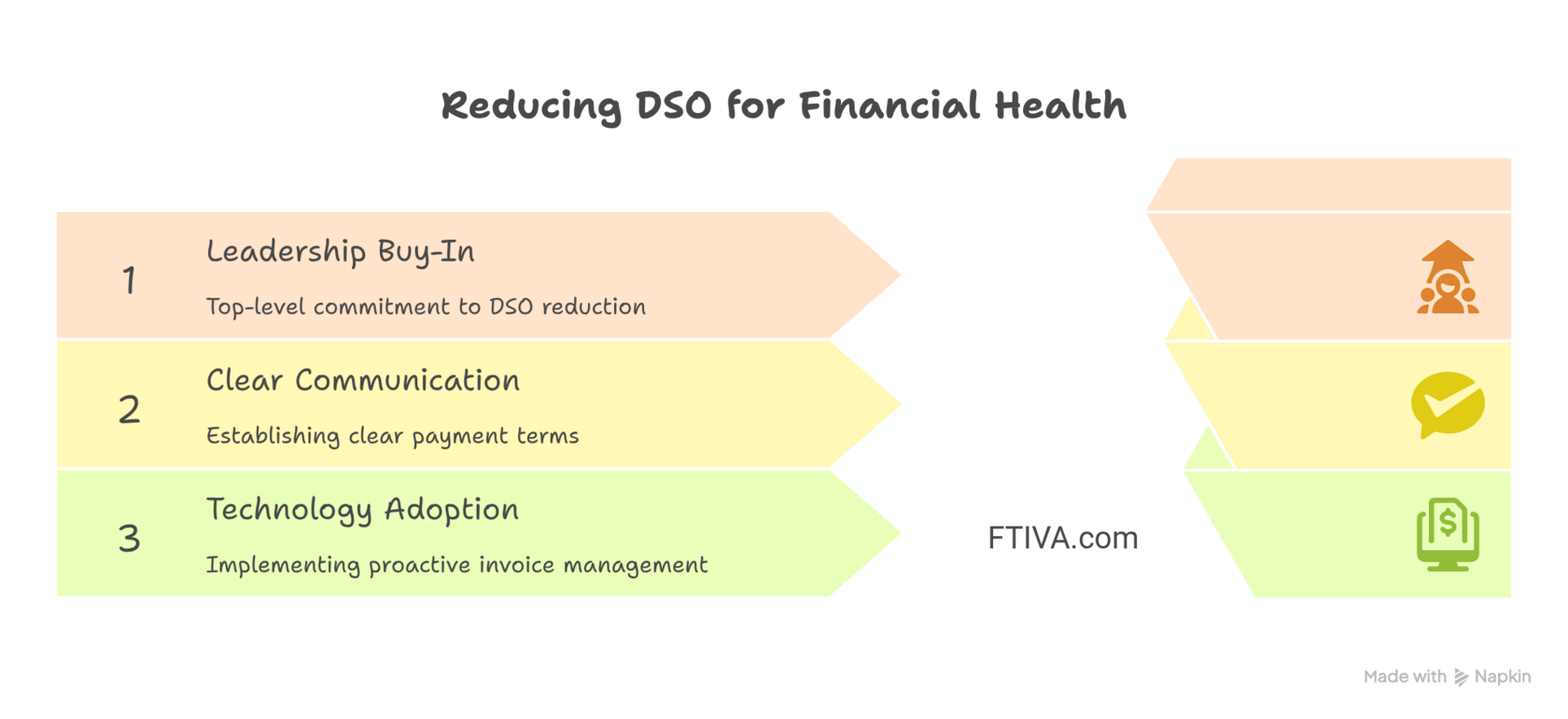

How to Take Control of Your DSO

Bringing your DSO down is a strategic effort, not just a procedural one.

- Leadership Buy-In: It starts at the top. When the entire leadership team understands the strategic importance of a low DSO, it becomes a company-wide priority, not just a finance team problem.

- Clear Communication as a Standard: Make sure your payment terms are not just clear but are also the cornerstone of your client communication. A positive and professional payment experience begins long before the invoice is due.

- Harness Technology for Proactive Management: You can't rely on manual follow-ups. A proactive system is essential for consistent, professional management of your invoices, ensuring no opportunity is missed.

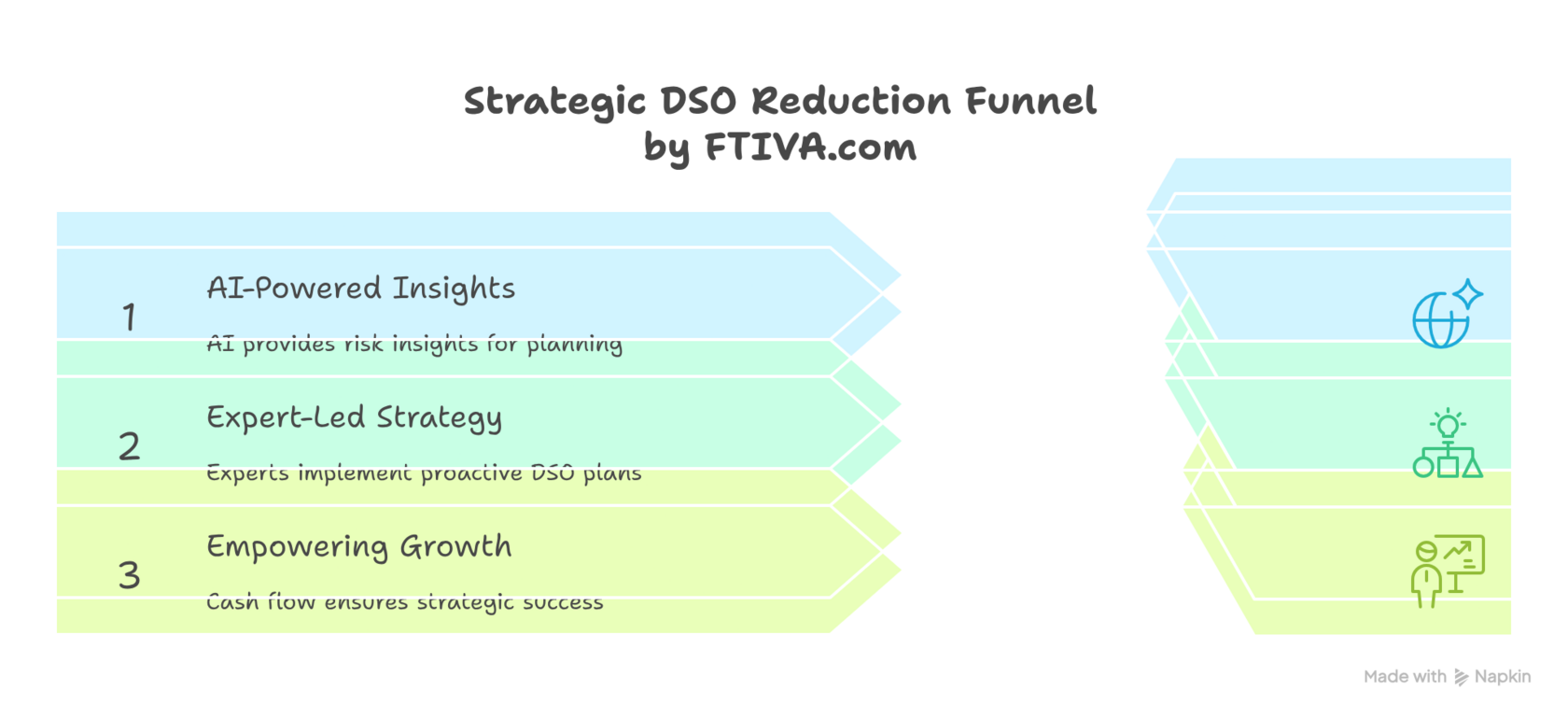

FTIVA: Your Strategic Partner in Reducing DSO

Managing a low DSO requires a combination of technology and strategic thinking. This is where FTIVA provides a unique advantage.

- AI-Powered Insights: Our system doesn't just manage invoices; it provides insights that help you and your leadership team understand where the risks are, allowing for proactive planning.

- Expert-Led Strategy: Our team helps you implement a proactive plan that not only lowers your DSO but also empowers your finance team to be more strategic.

- Empowering Growth: By ensuring a predictable and healthy cash flow, we help you remove the hidden obstacles to your best-laid plans.

By making DSO a strategic priority, you're not just improving a number; you're taking a vital step toward securing your company's future and ensuring your boldest plans have the financial fuel they need to succeed.

About Author

Written by Alex Fe — CEO, business strategist, and Senior Business Development Leader with 17+ years of international experience building and scaling companies across Europe, the US, UK, and Latin America. Alex has led organizations from startups to unicorns, contributing to a $1.2B acquisition and a $13B IPO — the largest tech listing in UK history.

His career spans executive roles where he managed finances, scaled operations, and built commercially successful ecosystems by combining technology, automation, and data. Alex specializes in helping both SMEs and global enterprises achieve predictable cash flow, financial resilience, and superior business outcomes. Today, through FTIVA, he partners with teams to accelerate strategies, optimize financial performance, and unlock long-term growth.

His career spans executive roles where he managed finances, scaled operations, and built commercially successful ecosystems by combining technology, automation, and data. Alex specializes in helping both SMEs and global enterprises achieve predictable cash flow, financial resilience, and superior business outcomes. Today, through FTIVA, he partners with teams to accelerate strategies, optimize financial performance, and unlock long-term growth.