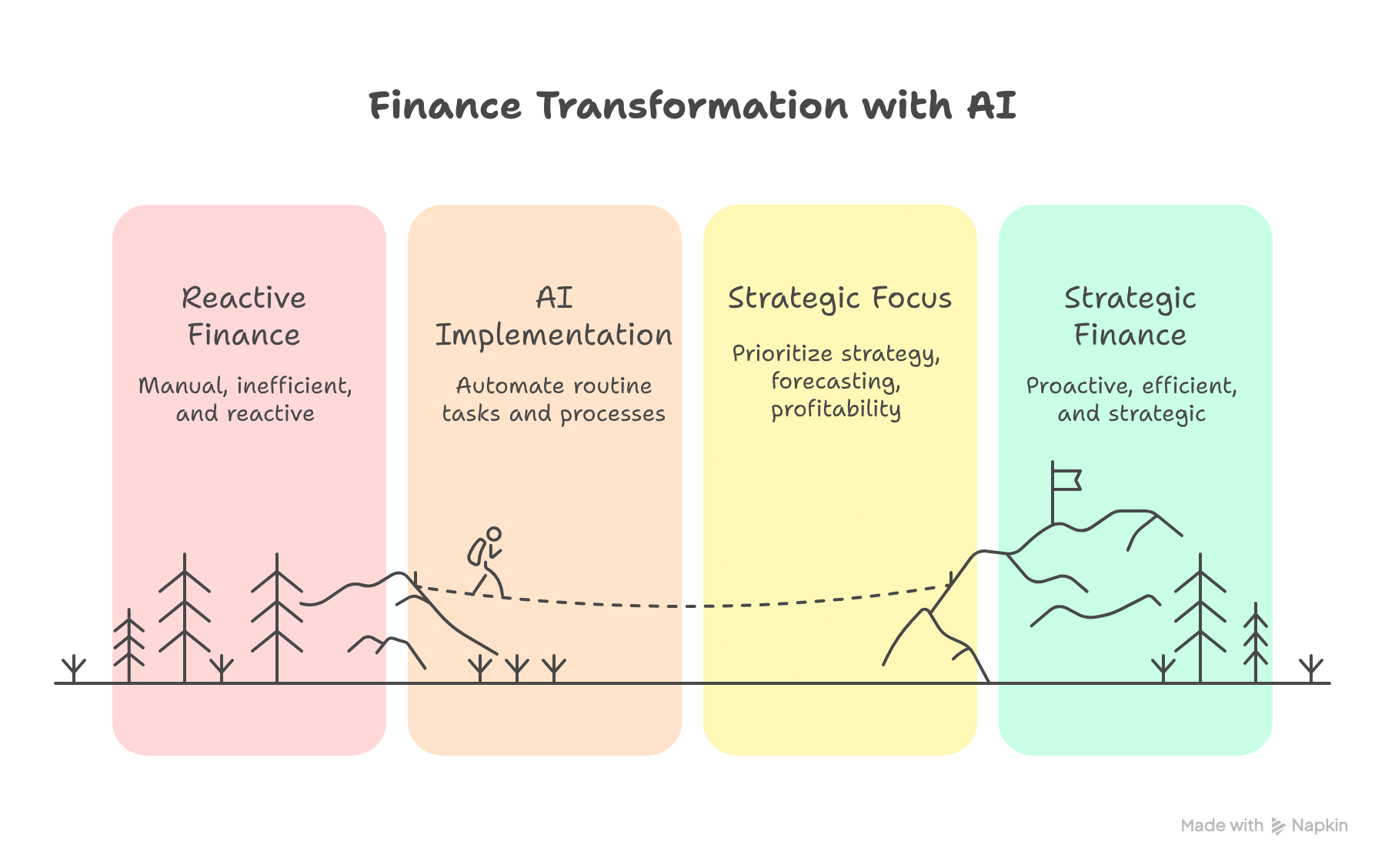

From Reactive Finance to Strategic Leadership

For decades, finance teams have been defined by their spreadsheets, manual processes, and the tedious task of chasing invoices. This reactive model is not just inefficient — it’s a bottleneck for business growth.

But CFOs are entering a new era. According to Deloitte’s 2024 Global CFO Survey, 64% of finance leaders list AI-driven automation as their top priority for finance transformation. The reason is simple: artificial intelligence frees finance teams from repetitive work, empowering them to focus on strategy, forecasting, and profitability.

This isn’t about replacing people with robots. It’s about elevating your team to become strategic leaders by letting AI handle the routine.

Life Before AI: The Daily Grind of Finance Teams

A typical day in a manual, spreadsheet-driven finance department looks like this:

- Checking payment terms and due dates one by one.

- Sending countless reminder emails.

- Cross-referencing overdue accounts across multiple spreadsheets.

📉 The result: wasted hours, rising labor costs, and finance teams buried in low-value work. McKinsey estimates that up to 42% of finance tasks are fully automatable — yet many businesses still waste resources on them.

The AI Advantage: A Strategic Shift for CFOs

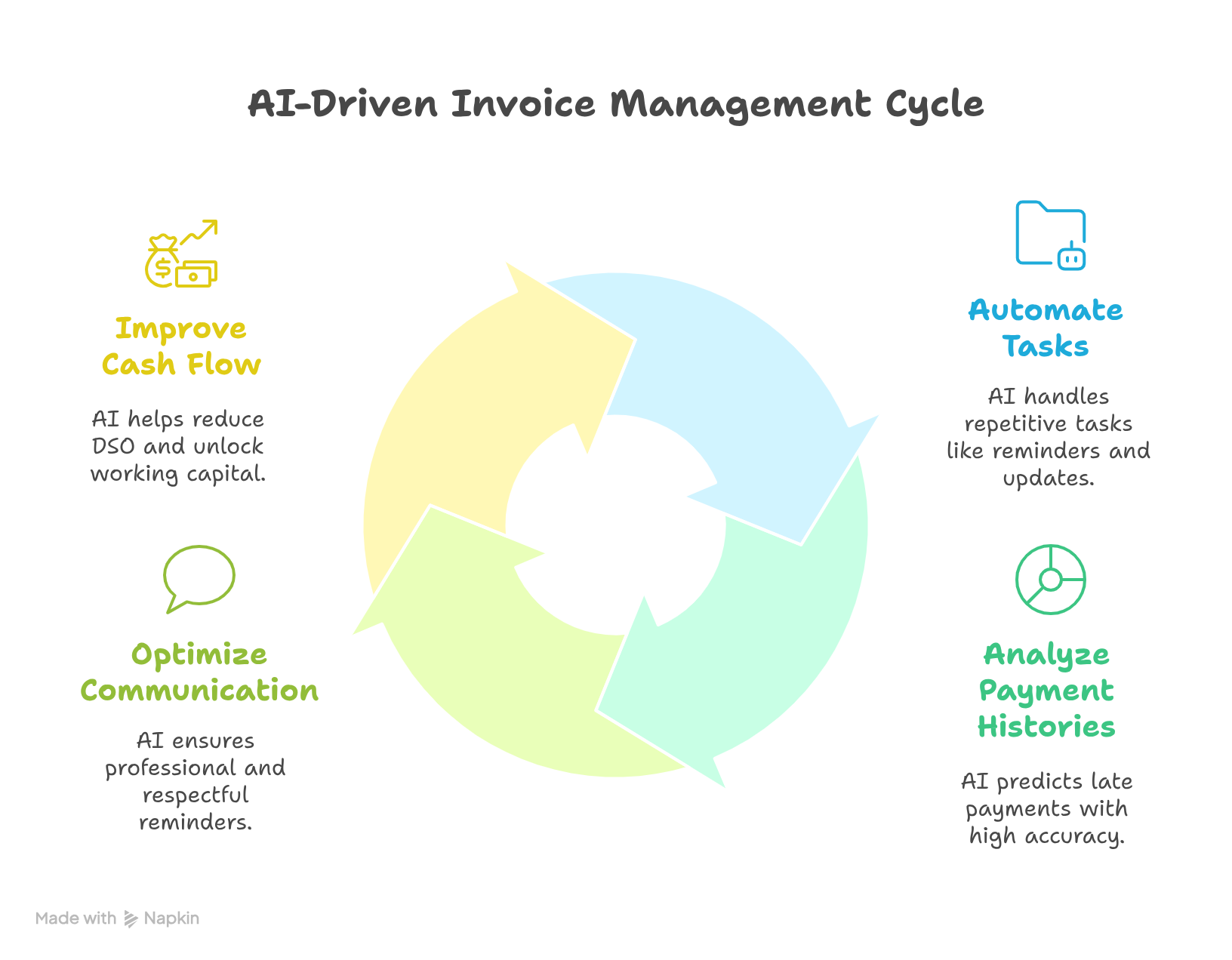

Integrating AI into invoice management isn’t a software upgrade — it’s a fundamental shift in how finance teams operate.

1. AI as a Personal Assistant

AI takes over the repetitive tasks: automated reminders, consistent follow-up, real-time updates. One FTIVA client reduced their Days Sales Outstanding (DSO) from 52 days to 34 days within 3 months — unlocking over €1.2M in working capital.

2. AI as a Strategic Analyst

AI doesn’t just chase invoices. It analyzes payment histories to predict which invoices are at risk of delay — often 10 days before the due date — giving CFOs time to act. FTIVA’s AI achieves 85% accuracy in forecasting late payments, allowing proactive cash-flow planning.

3. AI as a Relationship Protector

Collections are a sensitive process. AI optimizes communication timing and tone, ensuring reminders are professional and respectful. This keeps client relationships intact while protecting cash flow.

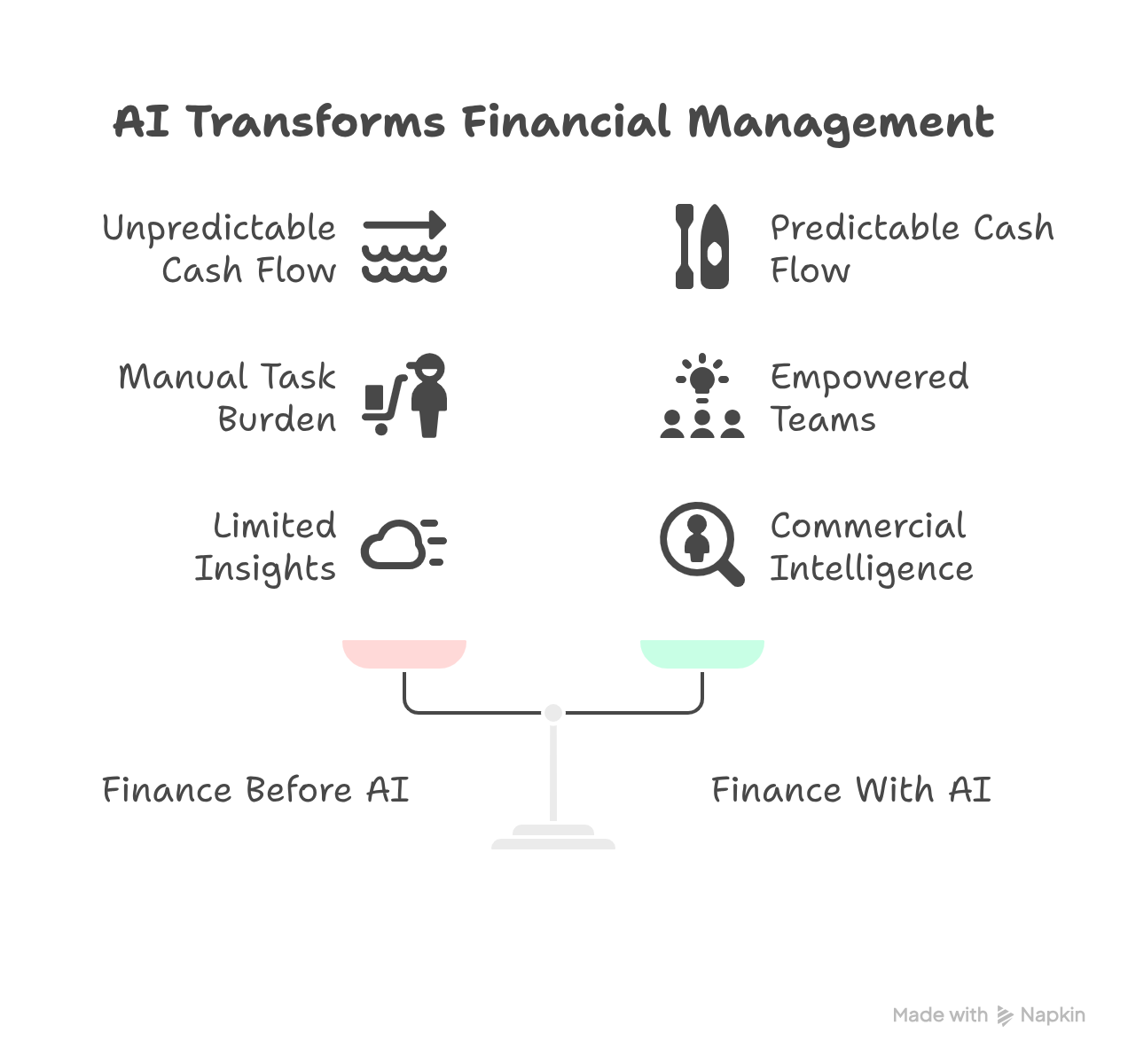

Moving Beyond Spreadsheets with FTIVA

At FTIVA, AI is not an add-on. It’s the engine of our platform, designed for CFOs who need predictable cash flow and strategic insight. Together with our expert team, the system delivers three core benefits:

- Predictable Cash Flow: AI-driven follow-ups stabilize payment cycles.

- Empowered Teams: Manual tasks vanish, freeing your people to focus on financial strategy and growth.

- Commercial Intelligence: Payment behavior becomes insight — identifying churn risks, upsell opportunities, and client health signals.

Why This Matters for CFOs

Late payments aren’t just operational noise. They limit strategic planning, investment decisions, and scalability. CFOs who implement AI-driven invoice management report:

- 30–40% faster collections in the first 90 days.

- Reduced reliance on costly short-term credit.

- Improved forecasting accuracy, supporting better growth decisions.

The future of financial management is not about working harder. It’s about working smarter — and leading from the front.

The CFO's Business Case for AI: ROI Calculator

Calculate Your Potential Savings:

Current Manual Process Costs:

- Finance staff time on collections: 20-40 hours/month × €50-80/hour = €1,000-3,200/month

- Late payment costs: 5-8% of annual revenue lost to delayed cash flow

- Borrowing costs from cash flow gaps: 3-7% interest on short-term credit

AI Implementation ROI (6-month projection):

- Reduce collection time by 70%: Save €700-2,240/month in labor costs

- Improve DSO by 15-25 days: Unlock €100,000-500,000 in working capital

- Reduce late payments by 40-60%: Recover 2-4% of annual revenue

Typical CFO Return: €3-7 saved for every €1 invested in AI invoice management

AI Implementation Strategy: The CFO's 90-Day Playbook

Phase 1 (Days 1-30): Assessment and Foundation

- Audit current finance processes and identify automation opportunities

- Calculate baseline metrics: DSO, collection costs, late payment rates

- Select AI solution based on integration capabilities and ROI potential

- Begin data preparation and system integration planning

Phase 2 (Days 31-60): Deployment and Team Training

- Implement AI invoice management system

- Train finance team on new workflows and reporting dashboards

- Set up automated collection sequences and payment reminders

- Establish new KPIs and reporting structure

Phase 3 (Days 61-90): Optimisation and Scaling

- Analyze initial results and fine-tune AI parameters

- Expand automation to additional finance processes

- Develop predictive cash flow forecasting models

- Create board-level reporting on finance transformation impact

AI in Finance: CFO Questions Answered

What's the difference between AI and basic automation in finance?

Basic automation follows simple rules (send reminder after 30 days). AI learns from patterns, predicts outcomes, and adapts strategies. AI can predict which invoices will be late 10 days before due date with 85% accuracy.

How does AI integration affect existing ERP systems?

Modern AI finance solutions integrate seamlessly with existing ERPs (SAP, Oracle, NetSuite) through APIs. No need to replace your current system - AI enhances what you already have.

What security measures protect financial data in AI systems?

Enterprise AI platforms use bank-level encryption, comply with GDPR/SOX requirements, and often exceed security standards of traditional finance software. Data sovereignty and audit trails are maintained.

How do I measure the success of AI implementation in finance?

Track DSO reduction, collection cost per invoice, cash flow forecast accuracy, time saved on manual tasks, and overall working capital improvements. Most CFOs see measurable results within 60 days.

What's the typical learning curve for finance teams adopting AI?

Most finance professionals adapt within 2-3 weeks. The key is choosing intuitive platforms and providing proper training. AI should simplify workflows, not complicate them.

How does AI handle complex client relationships and payment disputes?

AI escalates complex situations to human team members while handling routine communications. It learns from past interactions to optimize timing and tone, actually improving client relationships.

The AI-Enabled CFO: Strategic Transformation

Traditional CFO Focus vs. AI-Enabled CFO Focus:

Before AI:

- 60% time on operations and compliance

- 25% on analysis and reporting

- 15% on strategy and planning

With AI:

- 20% time on operations (AI-automated)

- 30% on advanced analytics and insights

- 50% on strategic planning and business partnership

New Competencies for Finance Leaders:

- Data science fluency and AI tool selection

- Cross-functional collaboration with IT and operations

- Strategic business partnering skills

- Change management and team development

Conclusion: Take the Driver’s Seat

AI in finance isn’t theoretical. It’s a CFO’s lever to transform the role of finance from reactive bookkeepers to proactive business partners.

Your AI Finance Transformation Starts Now

The question for CFOs isn't whether AI will transform finance - it's whether you'll lead that transformation or be forced to catch up later.

Immediate Action Steps:

- Assess your current finance processes for automation opportunities

- Calculate the true cost of manual collections and late payments

- Research AI solutions that integrate with your existing systems

- Build a business case with clear ROI projections

- Start with a pilot program in invoice management

- Develop a comprehensive change management plan

- Set measurable KPIs for tracking transformation success

The CFOs succeeding in 2024 and beyond aren't just managing numbers - they're using AI to unlock strategic insights that drive business growth.

Ready to transform your finance function from cost center to strategic advantage? FTIVA has helped over 100 European CFOs implement AI-driven invoice management with an average 340% ROI in the first year.

Author

Written by Alex Fe — CEO, business strategist, and Senior Business Development Leader with 17+ years of international experience building and scaling companies across Europe, the US, UK, and Latin America. Alex has led organisations from startups to unicorns, contributing to a $1.2B acquisition and a $13B IPO — the largest tech listing in UK history.

His career spans executive roles where he managed finances, scaled operations, and built commercially successful ecosystems by combining technology, automation, and data. Alex specializes in helping both SMEs and global enterprises achieve predictable cash flow, financial resilience, and superior business outcomes. Today, through FTIVA, he partners with teams to accelerate strategies, optimize financial performance, and unlock long-term growth.

His career spans executive roles where he managed finances, scaled operations, and built commercially successful ecosystems by combining technology, automation, and data. Alex specializes in helping both SMEs and global enterprises achieve predictable cash flow, financial resilience, and superior business outcomes. Today, through FTIVA, he partners with teams to accelerate strategies, optimize financial performance, and unlock long-term growth.