In the world of B2B, a signed invoice isn't just a financial document—it's a rich source of data. By moving past the traditional view of invoices as simple requests for payment, you can unlock a new level of insight into your customer relationships. This is the power of commercial intelligence, and it can be your most effective weapon against customer churn.

Instead of waiting for a client to leave, you can use payment behavior to predict who is at risk and proactively strengthen that relationship.

According to Atradius, 41% of B2B invoices in Europe are paid late.

SMBs spend an average of 14 hours per week chasing payments.

What Is Commercial Intelligence in a Payment Context?

Commercial intelligence is the practice of gathering and analyzing data to gain a strategic advantage. In the context of payments, it means looking at more than just the payment amount and due date. It means analyzing a client's payment patterns, communication frequency, and overall engagement to predict their future behavior.

This is a shift from reactive problem-solving to proactive opportunity management. It allows you to move beyond the transaction and focus on the relationship.

How Payment Behavior Can Signal Churn

Your clients are already giving you clues about their satisfaction and loyalty. You just need to know what to look for.

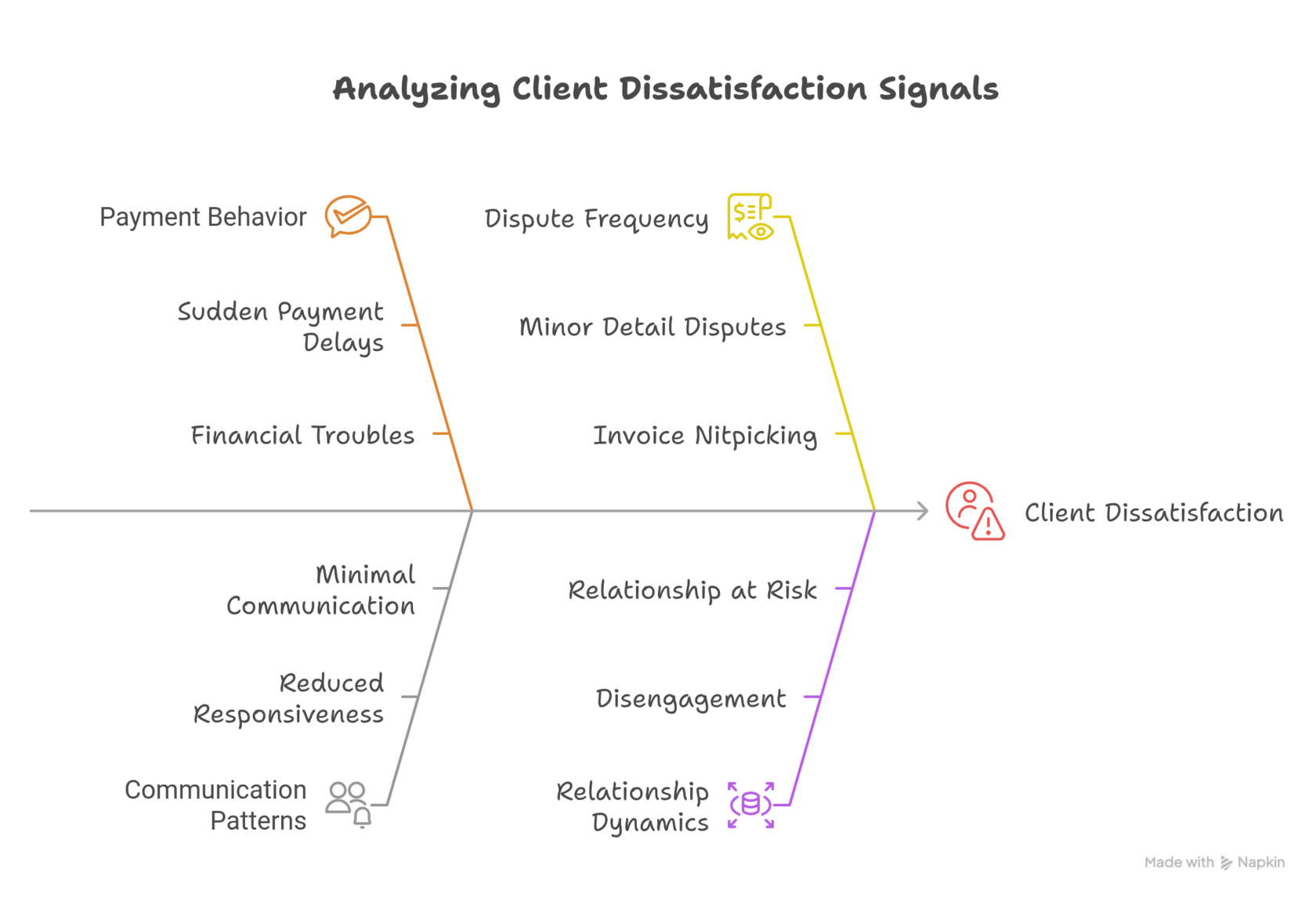

- A Sudden Shift in Payment Speed: A long-time client who always paid on time suddenly becomes consistently late. This could be a red flag. It may signal internal financial trouble on their end, or it could be a passive way of signaling their dissatisfaction with your service.

- The "Silent" Client: A client who used to be responsive suddenly becomes difficult to reach, only communicating when absolutely necessary. This disengagement, paired with a change in payment behavior, is a major warning sign.

- Disputes Over Minor Details: When a client starts to nitpick every invoice, it’s often a symptom of a larger dissatisfaction. This behavior, when combined with slow payment, can indicate that the relationship is at risk.

FTIVA's Role in Protecting Your Most Valuable Customers

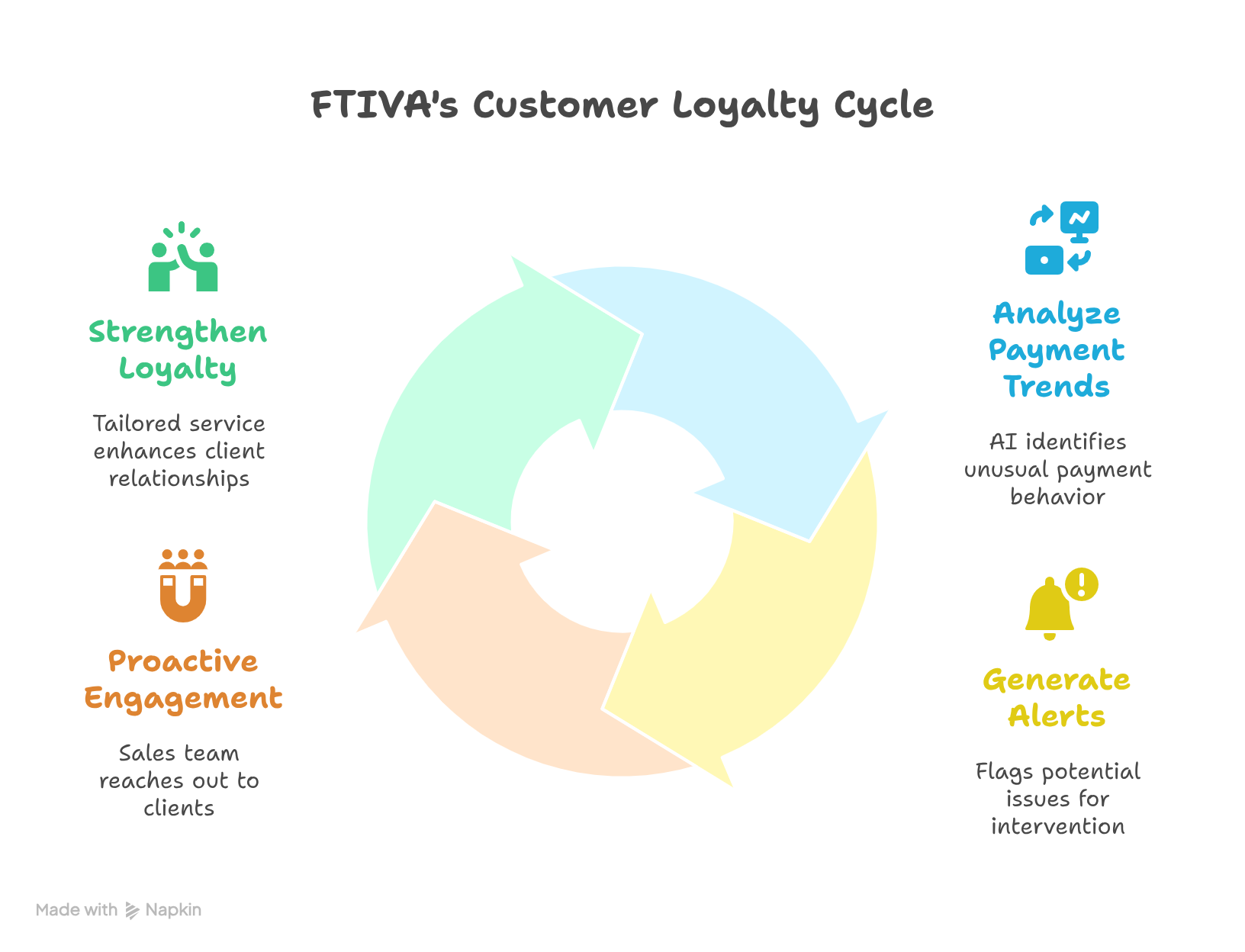

Identifying these subtle signals manually is nearly impossible, especially with a large client base. This is where FTIVA's proactive management system and AI technology provide a significant advantage.

- Data-Driven Alerts: Our platform uses AI to analyze payment trends and identify unusual behavior. It flags potential issues before they escalate, giving your team a chance to intervene.

- Proactive Engagement: With FTIVA, you can address these red flags strategically. Instead of a finance-focused conversation about a late payment, your sales or account management team can reach out to the client to check in on their satisfaction, demonstrating that you value them beyond the invoice.

- Strengthened Loyalty: By using commercial intelligence to understand your clients better, you can tailor your service and communication, reinforcing loyalty and turning at-risk clients back into happy, long-term partners.

By leveraging the insights hidden in your payment data, you're not just securing your cash flow—you're securing your customer base, and that’s the foundation of sustainable growth.

If your business is relying only on invoice reminders, you’re missing critical insights. FTIVA transforms your payment data into a powerful tool for retention, cash flow resilience, and growth. Contact us to see how commercial intelligence works in practice.

About Author

Written by Alex Fe — CEO, business strategist, and Senior Business Development Leader with 17+ years of international experience building and scaling companies across Europe, the US, UK, and Latin America. Alex has led organizations from startups to unicorns, contributing to a $1.2B acquisition and a $13B IPO — the largest tech listing in UK history.

His career spans executive roles where he managed finances, scaled operations, and built commercially successful ecosystems by combining technology, automation, and data. Alex specializes in helping both SMEs and global enterprises achieve predictable cash flow, financial resilience, and superior business outcomes. Today, through FTIVA, he partners with teams to accelerate strategies, optimize financial performance, and unlock long-term growth.

His career spans executive roles where he managed finances, scaled operations, and built commercially successful ecosystems by combining technology, automation, and data. Alex specializes in helping both SMEs and global enterprises achieve predictable cash flow, financial resilience, and superior business outcomes. Today, through FTIVA, he partners with teams to accelerate strategies, optimize financial performance, and unlock long-term growth.