The $431 Billion Problem Nobody Talks About

In 2024, small and medium-sized businesses across Europe reported losing over $431 billion due to late or unpredictable payments (Atradius). Cash flow volatility isn’t just an accounting headache — it’s one of the top reasons SMEs fail, even when they have healthy sales pipelines.

The Hidden Cost of Cash Flow Chaos: Why 82% of Businesses Fail

Add after current intro: Beyond the $431 billion in late payments, consider these sobering statistics:

- 82% of small businesses fail due to cash flow problems (U.S. Bank)

- Companies with unpredictable cash flow grow 23% slower than those with stable flows (McKinsey)

- CFOs spend 40% of their time on cash flow management instead of strategic growth (Deloitte)

The real problem isn't revenue—it's timing. You can have a million-dollar contract and still face payroll challenges if cash doesn't arrive when needed.

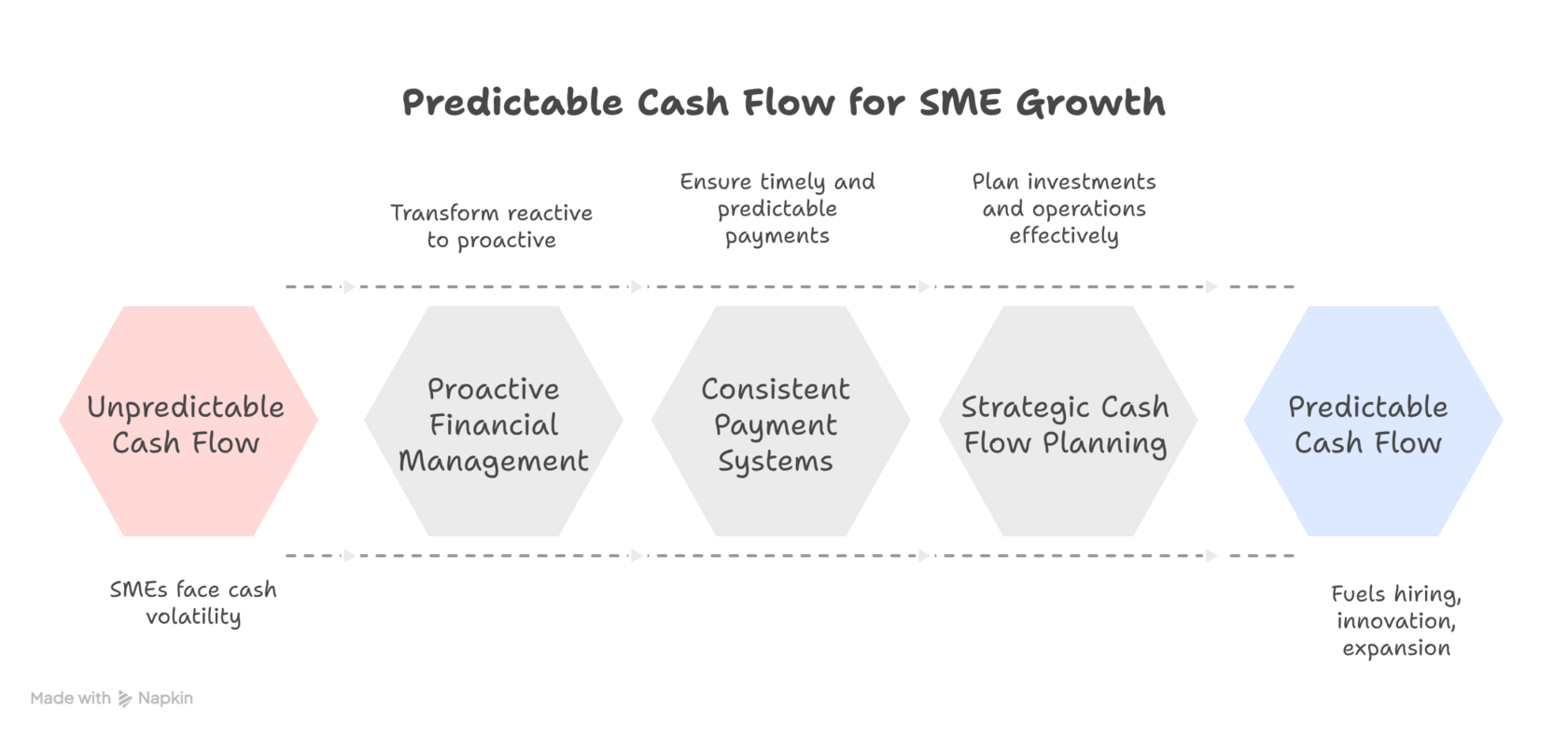

Cash flow is the lifeblood of any business, but for many, it feels more like a rollercoaster—a mix of feast and famine. When payments are inconsistent, it’s nearly impossible to plan for new investments, hire new talent, or expand your operations. The key to sustainable growth isn't just about making more sales; it's about making your cash flow predictable.

At FTIVA, we’ve worked with CFOs and finance teams who had strong revenues but were constantly on edge — because cash didn’t flow when it was supposed to. The good news? By setting up predictable systems, cash flow can move from chaos to a growth engine that fuels hiring, innovation, and expansion.

Here’s a guide to transforming your financial management from a reactive, stressful process into a proactive engine for growth.

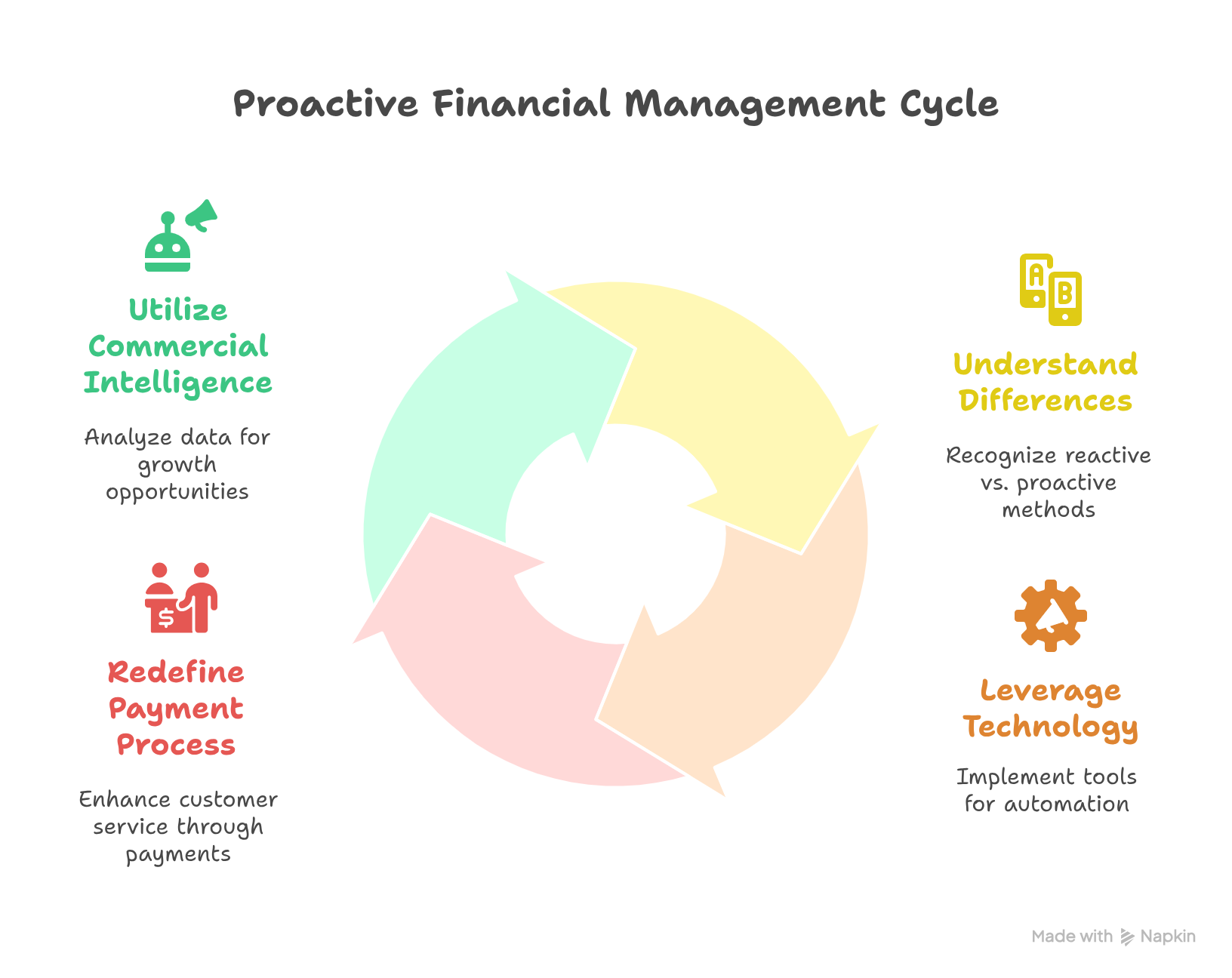

1. Understand the Difference: Reactive vs. Proactive Financial Management

Most businesses operate in a reactive mode. Invoices are sent, and follow-up only begins once a payment is late. This approach is not only inefficient but also places strain on both internal resources and client relationships.

Proactive financial management, on the other hand, is a strategic mindset. It involves taking steps before an invoice is due to encourage timely payment and maintain a healthy, predictable flow of funds. This approach is not about chasing overdue payments, but about building a system that makes late payments the exception, not the rule.

2. Leverage Technology to Automate and Optimize

In today's market, manual processes are a major bottleneck. Implementing technology is the most effective way to bring consistency and efficiency to your invoice management.

- Automated Reminders: Use a system (most of the modern ERPs like Odoo, Xero have this function) to send automated, polite reminders leading up to the payment due date. This gentle nudge often prevents a late payment from ever occurring.

- Real-Time Visibility: Tools that provide a clear, real-time dashboard of your pending invoices allow you to identify potential issues early. Knowing which payments are on track and which aren’t is the first step toward predictability.

- AI for Risk Assessment: Advanced systems, like FTIVA, use artificial intelligence to analyze payment behaviors and flag potential risks. This allows you to prioritize your focus on clients who may need more attention without creating friction with your most reliable customers.

3. Redefine the Payment Process as a Customer Service Touchpoint

The way you handle payments is an extension of your customer service. Instead of an aggressive or impersonal follow-up, consider the payment process as an opportunity to build trust and reinforce a positive relationship.

- Offer Incentives: Providing benefits for early payment, such as a small discount or a value-added service, can be a powerful motivator.1 This rewards good behavior and creates a positive association with paying on time.

- Maintain Clear Communication: Ensure your invoices are crystal clear, with all necessary details and contact information readily available.2 A client should never have to call you to figure out how to pay.

4. Utilize Commercial Intelligence to Drive Growth

A truly proactive approach doesn't just manage invoices—it uses the data to fuel your sales. This is the core principle of commercial intelligence. By analyzing payment behaviors and client interactions, you can identify new opportunities.

- Identify Loyal Customers: Clients who consistently pay on time are your most valuable assets. Use this insight to prioritize them for upsells or special offers.

- Prevent Customer Churn: Consistent delays or payment disputes can be an early warning sign of a dissatisfied client. Using this data proactively allows you to address their concerns before they leave.

5. The FTIVA Approach: Expert-Led, AI-Powered, and Growth-Focused

If managing this system sounds complex, that's because it can be. This is where a specialized service like FTIVA comes in. We combine an expert-led team with powerful AI technology to handle the entire proactive invoice management process for you.

By focusing on predictable liquidity and using commercial intelligence, FTIVA transforms a cost-center function into a strategic pillar for growth. We manage the delicate balance of ensuring timely payments while strengthening your client relationships, freeing you to focus on your core business.

With a predictable cash flow, your business is no longer surviving—it's thriving, with the stability to plan for a successful and prosperous future.

Cash Flow Management FAQ: Expert Answers

What's the difference between cash flow and profit?

Profit is revenue minus expenses on paper. Cash flow is actual money moving in and out of your business. You can be profitable on paper but cash-poor in reality if customers pay late or you have high upfront costs.

How much cash reserve should a business maintain?

Most financial experts recommend 3-6 months of operating expenses in reserve. For seasonal businesses or those with volatile cash flows, 6-12 months provides better security.

What are the early warning signs of cash flow problems?

Key indicators include: consistently waiting for payments to meet payroll, declining gross margins, increased reliance on credit, delayed supplier payments, and founders deferring their own salaries.

How can I improve cash flow without getting more sales?

Focus on collection speed: offer early payment discounts, require deposits, implement automatic payment systems, negotiate better payment terms with suppliers, and consider invoice factoring for immediate cash.

What tools are essential for cash flow forecasting?

Use rolling 13-week forecasts, cash flow dashboards in your ERP, automated invoice tracking systems, and scenario planning tools for different growth situations.

When should I consider external cash flow management services?

Consider professional help when you're spending more than 10 hours weekly on cash flow issues, experiencing frequent cash crunches, or preparing for rapid growth that requires sophisticated financial planning.

Building Predictable Cash Flow: 90-Day Action Plan

Days 1-30: Foundation Assessment

- Audit current invoicing and collection processes

- Identify your top 20% of customers causing 80% of payment delays

- Set up basic cash flow forecasting (13-week rolling forecast)

- Implement automated invoice reminders

Days 31-60: System Optimization

- Negotiate better payment terms with new contracts

- Offer early payment incentives (2% discount for 10-day payment)

- Set up automatic payment options for recurring clients

- Create payment follow-up sequences

Days 61-90: Strategic Enhancement

- Analyze payment patterns to identify at-risk accounts

- Develop client-specific collection strategies

- Build cash flow buffers and contingency plans

- Integrate commercial intelligence insights

Cash Flow Solutions by Industry

Professional Services (Consulting, Legal, Accounting):

- Implement retainer models and milestone-based billing

- Use project-based payment schedules tied to deliverables

- Consider subscription-based service offerings

Manufacturing & Distribution:

- Negotiate supplier payment terms that align with customer payments

- Use purchase order financing for large orders

- Implement just-in-time inventory management

SaaS & Technology:

- Focus on monthly recurring revenue (MRR) optimization

- Offer annual payment discounts to improve cash flow timing

- Use churn prediction to protect recurring revenue

E-commerce & Retail:

- Optimize seasonal cash flow with inventory financing

- Use dynamic pricing based on cash flow needs

- Implement faster payment processing systems

Essential Tools for Cash Flow Management

Forecasting & Planning:

- Xero or QuickBooks for basic cash flow forecasting

- Float or Cashflow Frog for advanced 13-week rolling forecasts

- Fathom for financial reporting and analysis

Invoice Management & Collections:

- FTIVA for AI-powered proactive collections

- Chaser or Invoiced for automated follow-ups

- Stripe or GoCardless for recurring payment automation

Banking & Payment Processing:

- Mercury or Brex for business banking with cash flow insights

- Wise for international payments with better exchange rates

- PayPal or Stripe for faster online payment processing

Protecting Your Business from Cash Flow Shocks

Diversification Strategies:

- Spread revenue across multiple customer segments

- Avoid over-reliance on any single large client (max 20% of revenue)

- Develop multiple revenue streams or service lines

Financial Cushions:

- Maintain 6-month operating expense reserve

- Establish business lines of credit before you need them

- Consider invoice factoring or asset-based lending options

Early Warning Systems:

- Set up alerts for overdue invoices beyond 30 days

- Monitor days sales outstanding (DSO) trends monthly

- Track customer payment behavior changes

Measuring Cash Flow Improvement: Key Metrics

Essential KPIs to Track:

- Days Sales Outstanding (DSO): Target under 30 days

- Cash Conversion Cycle: Minimize time from investment to cash return

- Collection Effectiveness Index (CEI): Measure collection efficiency

- Cash Flow Forecast Accuracy: Track prediction vs. actual performance

Monthly Review Checklist:

- Review 13-week rolling cash flow forecast

- Analyze payment patterns by customer segment

- Assess collection team performance and adjust strategies

- Update cash flow projections based on sales pipeline

Conclusion: Turn Cash Flow into a Strategic Asset

Cash flow doesn’t have to be a rollercoaster. With automated invoicing, smart incentives, rolling forecasts, and buffers in place, you can make it predictable — and predictable cash flow is what unlocks real business growth.

The companies we’ve seen thrive don’t just sell more — they control when the money arrives. That’s the difference between being in survival mode and having the confidence to expand.

Question to ask yourself today: Are you managing cash reactively, or building the systems for cash flow predictability that fuels long-term growth?

From Cash Flow Chaos to Competitive Advantage

Predictable cash flow isn't just about survival—it's about strategic advantage. Companies with stable cash flows can:

- Negotiate better supplier terms with early payments

- Invest in growth opportunities without external financing

- Weather economic downturns with confidence

- Make strategic acquisitions during market dips

The question isn't whether you can afford to invest in cash flow management—it's whether you can afford not to.

Ready to transform your cash flow from liability to strategic asset? Contact FTIVA to discuss how AI-powered collections and commercial intelligence can stabilize your financial foundation for accelerated growth.

About Author

Written by Alex Fe — CEO, business strategist, and Senior Business Development Leader with 17+ years of international experience building and scaling companies across Europe, the US, UK, and Latin America. Alex has led organizations from startups to unicorns, contributing to a $1.2B acquisition and a $13B IPO — the largest tech listing in UK history.

His career spans executive roles where he managed finances, scaled operations, and built commercially successful ecosystems by combining technology, automation, and data. Alex specializes in helping both SMEs and global enterprises achieve predictable cash flow, financial resilience, and superior business outcomes. Today, through FTIVA, he partners with teams to accelerate strategies, optimize financial performance, and unlock long-term growth.

His career spans executive roles where he managed finances, scaled operations, and built commercially successful ecosystems by combining technology, automation, and data. Alex specializes in helping both SMEs and global enterprises achieve predictable cash flow, financial resilience, and superior business outcomes. Today, through FTIVA, he partners with teams to accelerate strategies, optimize financial performance, and unlock long-term growth.

Sources used:

Atradius European Payment Report 2024, Deloitte SME Finance Report.

Atradius European Payment Report 2024, Deloitte SME Finance Report.